Tax Credits

Receive a loan collateralized by state tax incentives. These incentives can come in the form of a credit or rebate. The lenders on the Blue Fox platform specialize in this type of financing structure and can lend the money before a film starts production, during production, or after production has been completed.

-

Answer a Few Questions

Fill out our form and give us some details on the kind of financing your project needs. We will personally contact you regarding your needs and to customize how we take to the marketplace.

-

Connect With Lenders

We go out to our marketplace of debt and gap financiers to find you the best partner for your project.

-

Choose And Close!

We work together with you comparing offers as they come in, making sure we find the absolute best loan that works for you.

- Film Tax Credit: an incentive offered by some state and local governments to offset the cost of film production.

Credits are generally given in exchange for employing domestic workers and using local resources, to promote regional economic development.

- Minimum Spend: Threshold amount spent locally by the production to qualify for the film incentive.

- Discount: the difference between 100% of the tax credit value and the amount a tax credit Buyer is willing to pay

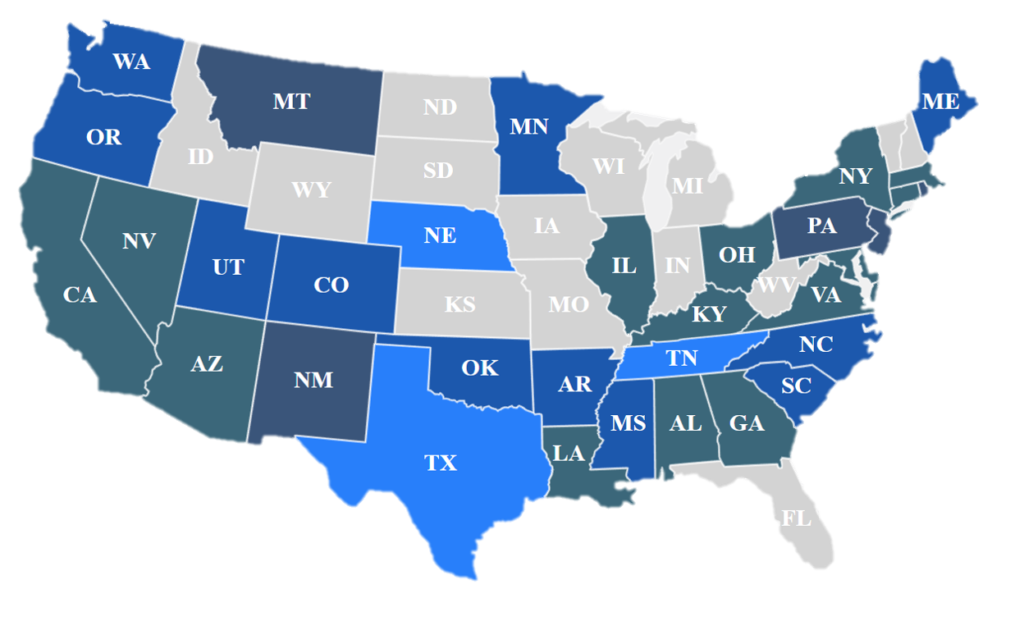

Find State Film Incentive Using Our Interactive Map

Find Film And TV Financing That’s Right For You Now